We named American Home Shield as Georgia’s best home warranty provider for its strong heating and cooling system coverage—which is essential for the state’s hot summers. Choice Home Warranty is another top pick, offering an affordable basic plan that covers important home systems and appliances.

After reviewing 13 leading home warranty companies, we selected the best options for Georgia homeowners. From scorching summers that can strain your air conditioning to heavy rains that can cause plumbing and roof leaks, a reliable home warranty can help you save time and money on unexpected repairs. Below, we break down the best home warranty options for Georgia residents and offer advice on choosing the right provider for your needs.

Key Takeaways

- We selected American Home Shield as the best home warranty provider in Georgia, reflecting our 2025 survey results, in which 60% of residents also chose the company.

- The average cost for a Georgia home warranty is $44–$82 per month, or $525–$964 per year, based on quotes we collected from top-rated companies.

- Our survey found that 28% of Georgia residents prioritized electrical coverage when choosing a home warranty.

Top Home Warranty Companies in Georgia

After reviewing 13 of the top home warranty companies, these are our picks for Georgia homeowners:

- American Home Shield: Best Comprehensive Coverage

- Choice Home Warranty: Best Basic Plan Coverage

- Elite Home Warranty: Best for Flexible Coverage

- First American Home Warranty: Best for High-End Items

- Liberty Home Guard: Best Customer Support

Comparing Top Providers

The following table compares our top Georgia home warranty providers based on key factors to consider when choosing a provider. These factors include cost, Better Business Bureau (BBB) ratings, and service call fees, which customers pay for each service technician visit. We based monthly costs on over 4,000 sample quotes for single-family homes both under and over 5,000 square feet. We averaged these quotes to determine the final pricing.

| Company | Star Rating | BBB Rating | Monthly Cost | Service Fee |

|---|---|---|---|---|

B | $36–$100 | $100–$125 | ||

B | $60–$68 | $100 | ||

B | $45–$60 | $70 ($150 for after hours and weekends) | ||

B | $77–$130 | $100–$125 | ||

A+ | $57–$68 | $65–$125 |

| Provider | Our Score | Monthly Plan Cost* | Service Call Fee | Workmanship Guarantee | BBB Rating | Get a Quote |

|---|---|---|---|---|---|---|

| $29–$89 | $100–$125 | 30 days | B | VISIT SITE | ||

| N/A | $100 | 90 days | B | VISIT SITE | ||

| $47–$87 | $100–$125 | 30 days | B | VISIT SITE | ||

| $44–$58 | $70 | 90 days | B+ | VISIT SITE | ||

| $49–$59 | $65–$125 | 60 days | NR** | VISIT SITE |

*Pricing may vary depending on your home’s location, size, type, and plan choices.

**The Better Business Bureau (BBB) is an organization that independently reviews companies’ credibility, reputation, and responsiveness. Ratings are accurate as of February 2024. A “No Rating” or “NR” means the BBB has not issued a rating due to an ongoing review or update to a company’s profile.

Our Reviews of Top Providers in Georgia

We recommend picking a home warranty company that most closely fits your specific needs and budget. For example, if you’re mostly interested in appliance coverage, we recommend companies with strong appliance-only plans, such as Liberty Home Guard. Or, if you’re concerned about covering expensive HVAC and plumbing systems, First American Home Warranty may be a better option because it has no limits on how much it will pay for these repairs per year.

Learn more about our favorite home warranty companies below.

American Home Shield

Workmanship Guarantee: 30 days

Coverage Overview

- Covers $5,000 in HVAC repairs—twice as much as most companies

- Offers discounts for heating and cooling tune-ups and air filters

- Provides roof-leak coverage in its highest-tier plan

Keep in Mind

- Has the highest prices of any company we reviewed

- Offers fewer ways to customize your coverage than other providers

Our Review

We recommend American Home Shield (AHS) to Georgia homeowners for a few reasons. First, it has a generous HVAC coverage limit of $5,000, which is double the industry standard of $2,500. A coverage limit is the maximum amount a company will pay for specific repairs within your plan term. Having high HVAC limits is invaluable for Georgia homeowners, given the state’s intense summers and nearly year-round heat. AHS also has discounts for heating and cooling tune-ups and air filter replacements. These help keep your HVAC system in good shape, preventing breakdowns in the first place.

There are two areas where AHS could be better: its plan variety and price. AHS doesn’t offer an appliance-only plan, so it’s not the best choice if you’re only interested in protecting appliances like refrigerators and dishwashers. As for its price, AHS is the most expensive company on this list.

Choice Home Warranty

Workmanship Guarantee: 90 days for parts, 60 days for labor

Coverage Overview

- Offers comprehensive coverage at reasonable prices

- Completes follow-up repairs if issues persist within 90 days, whereas most companies only do this within 30 days

- Covers up to $3,000 in claims for most items, $500 more than the industry average

Keep in Mind

- Doesn’t cover essential items in its basic plan

- Is facing a lawsuit filed by the Arizona Attorney General’s Office

Our Review

Choice Home Warranty stands out in one area: its value. Choice’s most expensive plan costs only $55 per month, making it one of the most affordable home warranties on this list. The company also has coverage caps of $3,000 for most of its covered items, which is $500 more than the industry average. Considering its low cost, these caps are extremely generous compared to other providers. Overall, we think Choice is a reliable “middle of the road” option that can work for homeowners of all budgets.

Our biggest concern is the lack of coverage in Choice’s basic plan, which doesn’t include essential items like refrigerators and air conditioning units. If you want these items covered, you’ll need to upgrade to a higher-tier plan. Most other providers cover these must-have items in their basic packages.

Another issue is that Choice is currently being sued by the Arizona Attorney General’s Office. The lawsuit alleges that Choice denied claims in bad faith. We contacted Choice about the lawsuit, and a representative said that while they could not comment on pending litigation, the company is “committed to providing best-in-class service to every customer.”

Elite Home Warranty

Workmanship Guarantee: 90 days

Coverage Overview

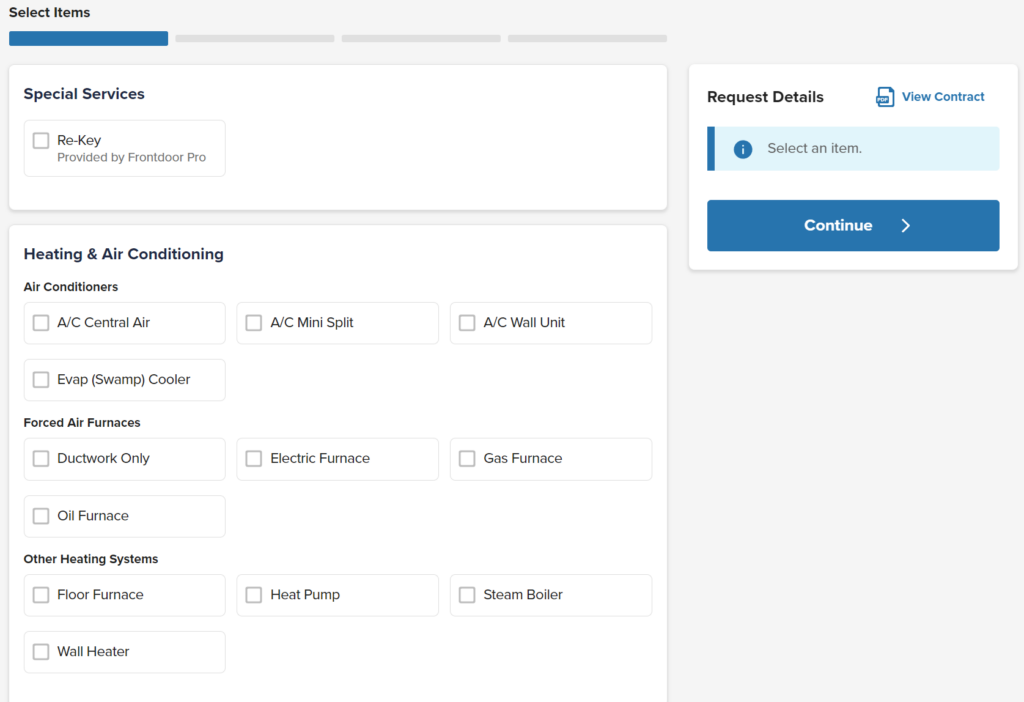

- Allows homeowners to completely customize their coverage plan

- Completes follow-up repairs if issues persist within 90 days

- Has more options to customize your plan than most companies

Keep in Mind

- Doesn’t allow you to use repair people outside of its network

- Has a $15,000 annual limit for total coverage, potentially limiting your payouts per year

Our Review

We recommend Elite Home Warranty to homeowners in Georgia who want specialized or custom coverage. Unlike most other home service providers, Elite lets you choose the exact items you want coverage for, so you won’t have to pay for things you don’t need. It also has 27 add-ons, which are options you can tack on to your base plan for extra coverage. Finally, we like Elite’s 90-day workmanship guarantee, which is three times as long as most companies. A “workmanship guarantee” means the company will arrange follow-up repairs for free if any issues occur after your initial repair within the stated time frame.

On the downside, this guarantee only applies to repair people within Elite’s network. This means that if you hire your own contractor, you’ll still need to pay a service call fee for return visits. We also think Elite’s $15,000 annual claim limit is restrictive. If you have multiple high-value claims and hit the $15,000 cap, you’ll have to pay out of pocket for any other repairs until your plan renews. If you have high-end home appliances or systems, we recommend picking a company that offers high or unlimited coverage caps, such as American Home Shield or First American Home Warranty.

First American Home Warranty

Workmanship Guarantee: 30 days

Coverage Overview

- Covers unlimited repairs for HVAC and plumbing

- Covers up to $7,000 for appliances in its top plan, over three times the industry standard

- Will cover improperly installed or damaged items as a free upgrade

Keep in Mind

- Doesn’t have appliance- or system-only plans

- Has higher-than-average prices

Our Review

First American Home Warranty (FAHW) is a good option for Georgia homeowners thanks to its unlimited coverage caps for HVAC and plumbing systems. If you have a larger home or a higher-end HVAC system, an unlimited coverage cap will keep you from paying out of pocket when things break down.

Similarly, FAHW’s free First American Advantage upgrade is great for older homes or those with already damaged items. This add-on covers items damaged from poor upkeep or faulty installation. Few other home warranty companies offer this kind of protection.

Similar to AHS, FAHW doesn’t offer system- or appliance-only plans, so you’re better off with a different company if that’s the only coverage you want. Another issue is that its cheapest plan, the Starter Plan, doesn’t cover roof leaks. Not all companies offer roof leak protection in their basic plans, but it’s a valuable perk for Georgians who regularly experience summer thunderstorms. You can buy this coverage as an add-on from FAHW for an extra $8.33 extra per month.

Liberty Home Guard

Workmanship Guarantee: 60 days

Coverage Overview

- Offers a 24/7 live chat for any-time customer service

- Includes a 60-day workmanship guarantee, double the industry average

- Has the largest add-on selection at over 40 items

Keep in Mind

- Doesn’t reveal its service call fee rates until after signup

- Has low plumbing and electrical coverage caps of $500

Our Review

We recommend Liberty Home Guard (LHG) to Georgia homeowners because of its impressive add-on selection of 42 items. This means that you can cherry pick almost any additional coverage you want without having to upgrade to a more expensive plan. LHG’s add-ons include coverage for items that many homeowners in Georgia would find helpful, such as two AC units, wells, sump pumps, and roof leaks. It also has coverage options for gutter cleaning, which can be a massive time-saver for homes in forested areas.

Liberty Home Guard comes up short on its service call fee policy and certain coverage caps. A service call fee is the one-time payment you make when a repair person comes to your home. Typically, a home warranty company will let you pick a higher service call fee if you want a lower monthly premium or vice versa. LHG doesn’t let you choose your fee. However, its service call fees range from $65–$125, which is in line with the industry standard.

LHG’s coverage falls within the industry average for most items, with the exception of plumbing and electrical systems. It only offers $500 of coverage for these, which is $2,000 below the standard.

Our Experience Filing Home Warranty Claims

To see what it’s really like to work with a home warranty company in Georgia, our team members interacted with providers’ customer service reps, signed up for contracts, and filed claims. Below, we outline what it looked like to file a claim with our top pick, American Home Shield, and our takeaways from the experience.

Testing American Home Shield

When one of our team members noticed a leak in their bathroom, they filed an online claim with American Home Shield. They found the process was quick and easy, and they received a confirmation email and text after submitting their claim. A technician reached out within five minutes to set a next-day appointment. The technician arrived early and repaired the leak within two hours.

Home Warranty Costs in Georgia

The average cost of a Georgia home warranty is $525–$964 per year or $44–$82 per month. This range is slightly lower than the national average home warranty cost of $564–$984 per year. However, the price of your specific plan will vary based on your location, plan, and add-ons.

| Average Home Warranty Cost in Georgia | National Average Home Warranty Cost | |

|---|---|---|

| Monthly | $44–$82 | $47–$82 |

| Annual | $525–$964 | $564–$984 |

How We Determined Home Warranty Pricing

To estimate home warranty costs in Georgia and across the U.S., we collected nearly 4,000 quotes from 13 companies in all 50 states. Using sample addresses, we gathered pricing for single-family homes both under and over 5,000 square feet in each state. For Georgia, this included quotes from Atlanta, Ellaville, Peachtree City, and Savannah, ensuring a mix of urban and rural areas. These state-level averages were then used to determine a national price range.

Survey Insights from Georgia Homeowners

We surveyed 2,000 home warranty users nationwide in 2025 to understand how they use their plans and their experiences with various providers. Our survey found that 49% of Georgia homeowners sought home warranty protection for older systems and appliances. This aligns with homeownership trends in the state as 67% of respondents reported living in pre-owned homes. Coverage was the top factor for Georgia homeowners when choosing a plan, with 57% of respondents prioritizing it.

When selecting coverage, 72% of respondents opted for comprehensive plans that included both systems and appliances. Among specific coverage priorities, 28% focused on electrical systems, while 44% prioritized water heater protection. Many homeowners also expanded their plans with add-ons, with the most popular options being roof-leak coverage (36%), supplemental home appliance protection (31%), and additional system coverage (29%).

Most Georgia residents had positive experiences with the claims process, with 92% of respondents being approved for their most recent claim. System repairs or replacements were the most common claims, and item replacement was the most frequent resolution. Overall, Georgia homeowners reported being satisfied with their home warranty coverage, with 53% reporting they were satisfied and 29% saying they were very satisfied. Nearly 75% of homeowners plan to renew their coverage when their current term ends, indicating strong satisfaction and trust in their plans.

How We Collected Our Survey Data

To better understand real homeowner experiences with home warranties, we surveyed 2,000 plan holders nationwide in 2025. The survey focused on reasons for purchasing warranties, satisfaction with coverage options, and experiences with claims and customer service. It also explored factors such as pricing, add-on coverage choices, and renewal intentions.

FAQs About Home Warranties in Georgia

What is the best home warranty company in Georgia?

American Home Shield is the best home warranty company in Georgia, according to our review. The company has strong HVAC coverage, which is important during Georgia’s hot summers, plus high coverage caps.

Is a home warranty required in Georgia?

No, there is no legal requirement to own a home warranty in Georgia.

What is typically included in a Georgia home warranty?

You can typically expect Georgia home warranty coverage to include protection for the following items:

- Common kitchen appliances

- Refrigerators

- Built-in microwaves

- Dishwashers

- Cooktops

- Ovens

- Garbage disposal systems

- Clothes washers

- Clothes dryers

- Water heaters

- HVAC systems

- Ductwork

- Garage door openers

- Plumbing stoppages

- Well pump and sump pump

- Septic system

How We Evaluated Home Warranty Providers

Below is an outline of the research and scoring criteria we used to choose Georgia’s top home warranty providers.

Our Rating System

When picking the best home warranty providers in Georgia, we researched the top companies in the state, consulted industry experts, analyzed service contracts, secret-shopped plans, surveyed thousands of customers, and spoke with real home warranty owners.

Using this research, our team developed a detailed methodology to score each company on six categories: coverage (35%), cost (20%), trustworthiness (15%), plan transparency (10%), customer support (10%), and flexibility (10%).

When judging home warranty providers for Georgia homeowners, we considered these key factors:

- HVAC coverage: Georgia has sweltering hot summers and a high average temperature. Because of this, one of the most important systems for Georgia homeowners is their HVAC. We rewarded companies that offer comprehensive HVAC coverage and gave extra consideration to providers with HVAC-focused add-ons, such as tune-up discounts or extra air conditioner coverage.

- Quality and trustworthiness: A home warranty is only worth investing in if it actually delivers what it promises. As such, the home warranty provider must fulfill the end of the agreement promptly and honestly. We thoroughly and critically read customer reviews, analyzed survey results, and spoke with real homeowners to ensure the companies we recommend are worth your time and money. If a company has a track record of failing to fulfill its promises, has active lawsuits against it, or shows other major red flags, we investigate the claims fully and won’t recommend providers we think fall short.

- Opinions from real homeowners: To understand what it’s actually like to work with a home warranty company, you need to talk to real homeowners who use these services. We interviewed homeowners directly about their experiences with home warranty providers. We also surveyed thousands of home warranty customers to get a feel for how each company performs on a larger scale.